The annual AAOE Benchmarking Survey collects data from orthopaedic practices across the country to give practice professionals the data they need to make strategic decisions. The results from the latest survey, the Benchmarking Results for Data Year 2017, include four years of trend data from more than 300 orthopaedic practices representing a full range of practice sizes, specialties, population sizes, and regions.

The top trends from the latest survey provide key insight into the unique challenges orthopaedic practices are facing in today’s environment. How does your practice compare?

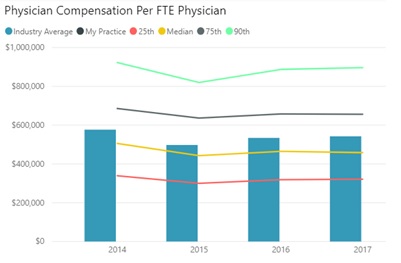

Physician Compensation Remained Lower Than 2014 But Increased From 2015

Benchmarking physician compensation across orthopaedic practices and specialties is essential when discussing compensation levels and developing compensation models. When used in combination with other available benchmarks (e.g., net collections, productivity, payer mix), compensation benchmarks can provide the data needed to make effective compensation decisions.

Average compensation for orthopaedic physicians, across all specialties, has increased from a low of $497,714 in 2015 to $542,414 in 2017. Compensation in 2017 remains lower than the average reported in 2014 ($576,820), however.

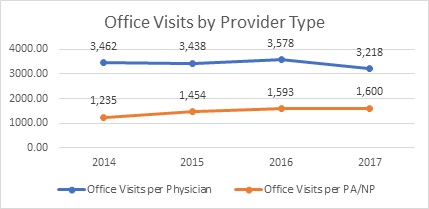

Number of Office Visits by Physicians Decreased While Number of Office Visits by PAs and NPs Increased

There are several measures of productivity for both physician and non-physician providers that can help provide context to the revenue and compensation trends observed within and across practices. The number of office visits is one of these measures and, as illustrated below, can have differing trends based on provider type. Reimbursement amounts for office visits may have contributed to these trends.

The average number of office visits for physicians decreased from 3,462 in 2014 to 3,218 in 2017, while the number of visits conducted by physician assistants and nurse practitioners increased from 1,235 to 1,600 during the same period. The average number of surgical cases increase slightly from 443 in 2014 to 503 in 2017.

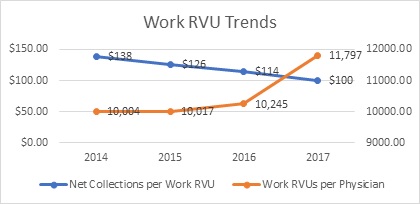

Number of Work RVUs Per Physician Increased While Price Per Work RVU Decreased

Work RVUs are another measure of productivity used in benchmarking. The trends observed below for both Work RVUs per Physician and Net Collections per Work RVU illustrate the importance of looking at a variety of available metrics when making decisions within an orthopaedic practice.

The average number of Work RVUs reported for physicians increased from 10,004 in 2014 to 11,797 in 2017, while net collections per Work RVU decreased from $138 to $100 during the same period.

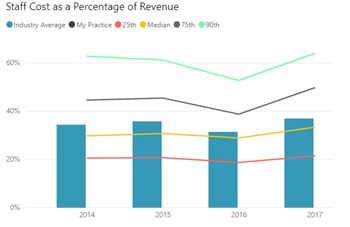

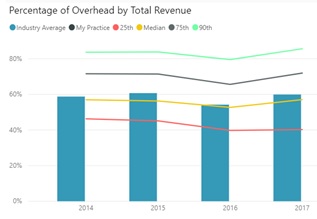

Staff Cost and Overhead as Percentages of Revenue Increased

Effectively managing overhead expenses, which include employee salaries and facility, medical, office, and other expenses not directly allocated to physicians, is important for all medical practices. Benchmarks related to staff cost and overhead can help determine what the optimal level of overhead should be, understanding that overhead rates that are too high or too low can result in negative outcomes for practices and providers.

Staff cost as a percentage of revenue increased from 34.4% in 2014 to 37.0% in 2017.

Percentage of overhead by total revenue increased from 58.8% to 60.0% during the same period.

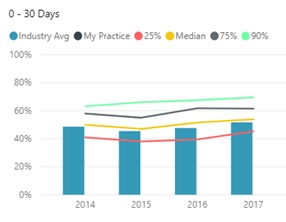

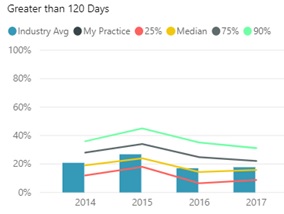

Improvement in Collection Processes

Monitoring the efficiency in which practices are able to collect payments for services is important to the overall financial health of a practice. The following benchmarking trends indicate improvement in collection processes used by orthopaedic practices over the past four years.

Percent of total accounts receivable in 0 to 30 Day aging category = 51.7%; highest level since 2014 (48.6%)

Percent in Greater than 120 Days category is 17.8%; lower than 2014 (20.9%); slightly higher than 2016 (17%)

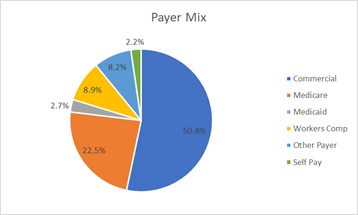

Commercial Insurance Is Primary Payer for Orthopaedic Care

Understanding the mix of payers represented within a practice is important because of the implications it has for net collections, productivity levels, and overall revenue.

Commercial insurance is the primary payer for orthopaedic care, making up 50.8% of net collections in 2017. Medicare (22.5%), workers’ compensation (8.9%), and other payers (8.2%), represent the next highest payers.

Benchmark Your Practice

This is only a glimpse at the reports included in the complete Benchmarking Results for Data Year 2017. Viewing the top trends is a great way to begin seeing how your practice stacks up against others, but to get the full picture, it is important to benchmark in other key areas. The results are housed in an interactive online data portal that lets you create custom reports based on factors such as your practice size, specialty, region, and state. This drills the data down to help provide answers as you make strategic decisions for your practice.

Get next year’s Benchmarking Results for free by participating in the survey, open now through June!